Mortgage Investment Corporation or MIC is an investment and lending company designed specifically for mortgage lending in Canada. Governed by Section 130.1 of the Income Tax Act, MICs pay no corporate tax and act as flow-through entities and have to pay out all their taxable income in the form of dividends. Owning shares in a mortgage investment corporation enables you to invest in a company which manages a diversified pool of mortgages.

Sample Case 1: text123

Property location: Midtown, Torotno

Property Value: $1,500,000, Single family house

Borrowing Amount: $150,000

LTV: 77%

Term: 1Y

Return: 10%

Borrower info: Lawyer, Borrow money for closing his new house

Sample Case 2: Text123

Property location: Ajax, Ontario

Property Value: $600,000, Single family house

Borrowing Amount: $30,000

LTV: 84%

Term: 6 month

Return: 12%

Borrower info: Car mechanics, pay off debt

Sample Case 3: Text 123

Property location: Oakville, Ontario

Property Value: $900,000, Single family house

Borrowing Amount: $80,000

LTV: 81%

Term: 1Y

Return: 11%

Borrower info: Online business in cosmetics, renovating the house

Why invest with us

Vicky is responsible for overseeing the day-to-day operations of the firm, building both new and existing business, and implementing overall strategy.

Vicky is the co-founder of Bay Street Real Estate Investment and Ubene Technologies. Vicky has developed a reputation for leading from the front line, working with teams and clients in developing and executing business plans which resulted in the advancement of the key strategic initiatives of each firm. Vicky had worked years in the capital market department of TD, RBC and IBM. Vicky obtained her Master degree from University of Toronto in 2005, and has completed the Real Estate Management Program from Harvard Business School in 2012.

Cindy is a serial entrepreneur, with a passion for building financial companies and technologies to make lending easier and faster for everyone involved. Cindy has more than a decade of banking experience, and is a private lender herself, building a pipeline of deals exceeding 10 million in the first year. She is also CEO of a SAP technology company, servicing Fortune 500 clients in Canada and US. Cindy is a graduate of Ivey School of Business at the University of Western Ontario.

Jeff is responsible for advising and counselling on mortgages and mortgage transactions.

Jeff is the managing partner at and co-founder of Levy Zavet PC, Lawyers. Jeff is practicing primarily in the areas of real estate, mortgages, corporate law, corporate finance, mergers and acquisitions, tax law, commercial finance and estate planning. Jeff is extremely experienced in drafting mortgage loan agreements and structuring multi-collateral, diverse payments and elaborate recovery provisions in every unique situation. His long history of experience in mortgage enforcement, power of sale, and foreclosures, has given him the knowledge to foretell viable exit strategies at the loan origination stage of almost every single mortgage deal.

Working within conservative risk parameters, we endeavor to enhance yields, dividends and common share value through the sourcing and efficient management of our mortgage investments.

Performing up to 15 customizable real estate fraud checks for potential suspicious activity and flag applications in the underwriting process for further investigation to lower the risk of real estate fraud

Ability to execute financing structures that are customized to the unique needs of borrowers to compete with the comparatively inflexible financing structures offered by large financial institutions.

Through the combination of many high quality mortgages into a diversified pool, we are able to mitigate the risks associated with investing in a single mortgage

Only lend on select real estate in select locations in order to sell the property. We will evaluate properties’ location, quality, market condition, existing leverage and net operating income ro ensure that in the event of default security can be liquidated to repay the mortgage debt in a timely manner.

Management relationships provide access to high quality real estate transactions in major urban centers

At least 50% of a MIC’s assets are comprised of residential mortgages, and/or cash and insured deposits at Canada Deposit Insurance Corporation member financial institutions.

Majority of our mortgages will have a term of one year or less. The short term duration of our mortgages reduces interest rate and credit risk.

Identify relatively low risk first and second mortgages with a maximum loan to value of 80%.

Paramount Global MIC focuses on residential properties in urban and suburban areas that are highly marketable. Paramount Global MIC’s clients are self-employed, new immigrants and borrowers with soft, poor or no credit. We mitigate the risk with our proprietary underwriting model

We deal strictly through licensed mortgage brokers and licensed agents. There are reportedly over 10,000 mortgage brokers and agents in Ontario. These represent our external sales force; identifying and referring mortgage.

Yes. In fact, in 1972, the Canadian government created provisions within the Residential Mortgage Financing Act to specifically allow for the creation of mortgage investment corporations. Paramount Global MIC is also specifically regulated by Financial Services Commission of Ontario (FSCO), the Ontario Securities Commission (OSC), along with other securities regulators. Generally accepted accounting principles (GAAP) also apply. In other words, we’re audited, regulated and adhere to strict financial guidelines.

In the province of Ontario the Financial Services Commission of Ontario (FSCO) licenses and regulates all mortgage brokers, agents and administrators. The Manager is a licensed administrator in Ontario.

All our mortgages are registered on the title of the property. We know the market, and the homes you drive by everyday. We lend based on the appraisal value done by professional appraisers. Our maximum loan value ratio is set at 80%.

Our mortgages have the same legal security as the mortgages from banks or other institutional lenders. All related legal work is performed by a lawyer or notary public for Paramount Global MIC. There is no guaranty, however your investment will not fluctuate.

Although real estate investing is considered one of the safest investments, risks still exist in mortgage lending. All property investments are subject to elements of risk. Property value is affected by general economic conditions, local real estate markets, the attractiveness of the property to tenants, competition from other available properties and other factors. While independent appraisals are required before the corporation may make any mortgage investment, the appraised values provided therein, even where reported on an “as is” basis, are not necessarily always reflective of the market value of the underlying property, which may fluctuate.

The MICs’ income and funds available for distribution to security holders would be adversely affected if a significant number of borrowers were unable to pay their obligations. Upon default by a borrower,Paramount Global MIC may experience delays in enforcing its’ rights as lender and could incur costs in protecting its investment.

To mitigate these risks, the experienced team of Underwriters at Paramount Global MIC review every application to reduce the possibility of non-performing loans. Furthermore, strict loan to value guidelines and a proactive approach to collections ensure enough equity is available to recover outstanding loan balances in case of foreclosure.

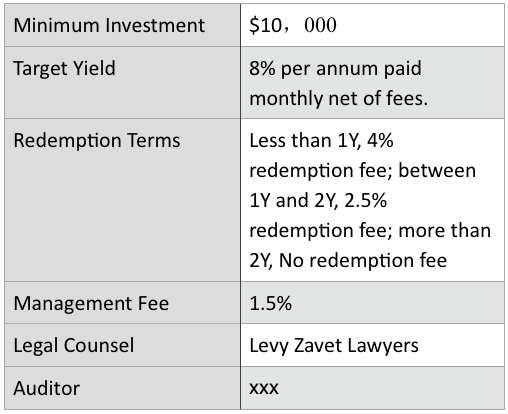

Preferred shares can be purchased at the beginning of every month. Our minimum investment is $10,000, once the minimum investment has been made, additional shares may be purchased with a minimum increment amount of $5,000.

Paramount Global MIC has a 24 month redemption period with early redemption fee(4% within first year and 2.5% between first and second year). After 24 momths, an investor can withdraw their funds simply by advising us in writing so that a redemption notice received will be effective within 15 days of the end of the quarter following the quarter in which the redemption request is received.

For income tax purposes, the returns that our investors receive are treated as interest, not as dividends.

Paramount Global MIC h supports investments from within a variety of registered plan types. We have selected COlympia Trust Company as our trustees for this purpose, due in part to their excellent support for MIC investments.